A Direct Earnings Attachment (DEA) is a powerful debt recovery solution used by public departments to directly deduct owed amounts from an individual employee’s earnings. This is often implemented without requiring a court order, making it an efficient way to recover overpayments, unpaid income taxes, and other debts owed to government authorities. So, what exactly is a Direct Earnings Attachment, and what does it mean for your paycheck? Let’s break it all down.

What is Direct Earnings Attachment?

What is Direct Earnings Attachment? A Direct Earnings Attachment, or DEA, is a legal process by which government bodies like the Department for Work and Pensions (DWP) or local councils recover debts by directly taking money from your earnings. This usually happens when you have an outstanding debt related to benefit overpayments, such as overpayments of Universal Credit, tax credits, or housing benefits. Instead of relying on you to make timely payments voluntarily, a DEA ensures the recovery by deducting directly from your wages.

How Does Direct Earnings Attachment Work?

If you’ve received a notification regarding a DEA, it’s essential to understand how it works. It involves more than just deducting money from your paycheck—there are various processes and regulations to ensure compliance with legal responsibilities.

Definition and Purpose of Direct Earnings Attachment

- Definition: What is Direct Earnings Attachment? A Direct Earnings Attachment is an administrative debt recovery solution that allows public departments to recover overpayments of benefits or other debts by directly deducting funds from your wages.

- Purpose: The main aim of a Direct Earnings Attachment is to recover debts like housing benefit overpayments, tax credit debts, and other benefit overpayments in a streamlined manner, without the need for a court order or extensive legal proceedings.

Initiation Process by the DWP

The Department for Work and Pensions (DWP) initiates a DEA after multiple unsuccessful attempts to collect an outstanding debt. Before a DEA is initiated, you are given multiple opportunities to repay or agree on a repayment scheme.

- Notification: You will receive written notification informing you about the DEA, the amount of debt owed, and how much will be deducted from your earnings.

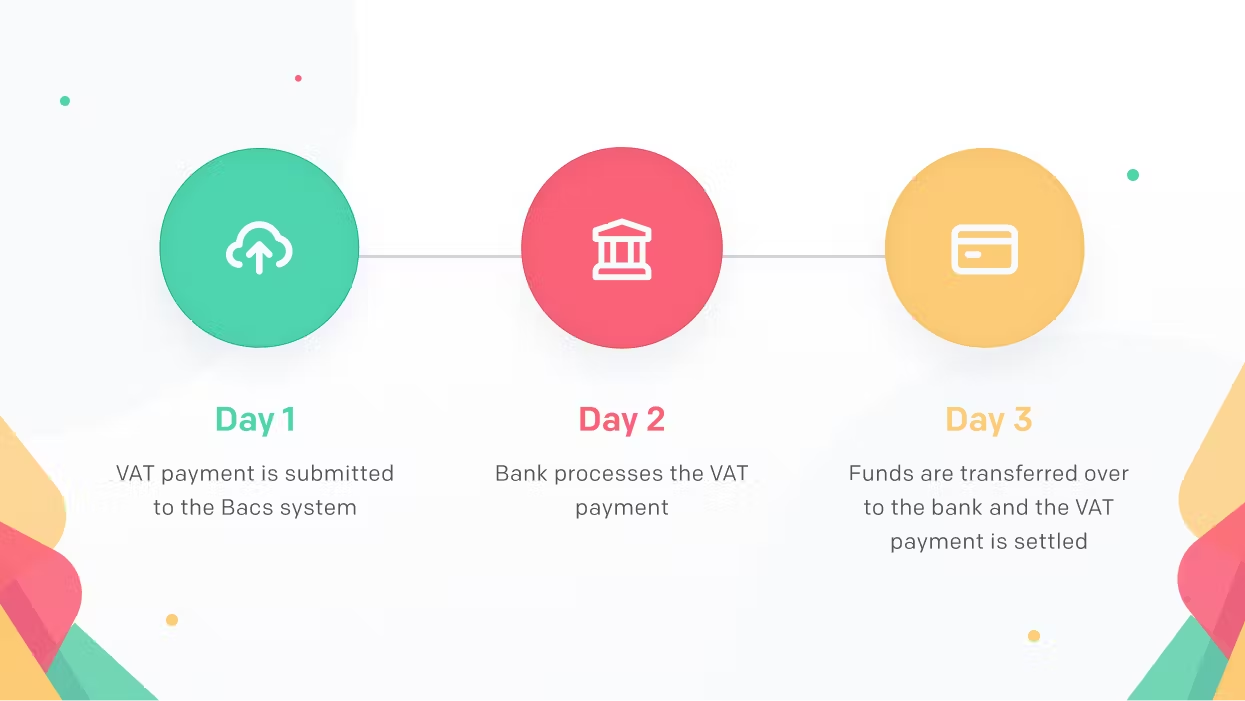

- Employer Contact: The DWP will then notify your employer, who is obligated to make the appropriate deductions from your wages and remit them to the relevant government department.

Employer Responsibilities

Employers play a crucial role in making sure that Direct Earnings Attachment deductions are conducted correctly. They must comply with the legal requirements regarding deductions, which means:

- Accurate Calculations: Employers must ensure the correct deduction percentage rate is applied, based on the employee’s monthly earnings and pay period.

- Reporting and Compliance: Employers are legally obligated to report the deductions, maintain records of all DEA deductions, and ensure they are remitted on time to the correct department. Non-compliance with these responsibilities can lead to legal consequences.

Calculating Deductions

The amount that can be deducted under a Direct Earnings Attachment depends on your income, and there are strict regulations to make sure the right amounts are being taken while protecting your ability to meet essential living expenses.

Understanding Qualifying Earnings

- Qualifying Earnings: Qualifying earnings refer to your earnings figure after statutory deductions such as National Insurance contributions, income tax, and workplace pension contributions. Statutory maternity, statutory redundancy, and certain allowances payable are excluded from qualifying earnings.

- Non-Qualifying Earnings: Some payments, like redundancy payments and travel allowances, are typically excluded from the qualifying earnings calculation.

Complying with Legal Requirements

Employers must comply with the deduction rates table provided by the DWP to calculate the correct amounts. The maximum deduction rate depends on how much the employee earns, and the calculation must consider the current pay period and correct deduction percentage rate.

- Maximum Deduction: The maximum deduction from earnings is calculated using a tiered approach. Employees with lower monthly income have smaller deductions, while those earning above a certain threshold may face larger deductions.

- Protected Earnings Limit: The protected earnings limit ensures that the deductions do not reduce your take-home pay below a certain level. This means that the amount left after deductions must be enough to cover essential living expenses.

Employee Rights and Responsibilities

If you are subject to a Direct Earnings Attachment, it’s important to be aware of your rights as well as your responsibilities. Proper understanding can help ensure that deductions are correct and that you are not left without the ability to meet essential financial obligations.

Understanding Your Rights

- Notification in Writing: You are entitled to receive a formal notification in writing before any deductions are made from your earnings. The letter should contain details about the debt owed and the deduction schedule.

- Protected Earnings: Direct Earnings Attachments cannot reduce your income below the protected earnings limit. This ensures that your earnings after deductions are enough to cover your basic needs, preventing severe financial hardship.

- Challenging a Direct Earnings Attachment: If you believe that a Direct Earnings Attachment has been issued incorrectly or the amount deducted is incorrect, you have the right to challenge it. In some cases, you can apply for a hardship exemption or request adjustments based on exceptional circumstances.

Impact on Credit Ratings

A common concern about having a Direct Earnings Attachment is whether it will affect your credit score. Luckily, a DEA does not directly appear on your credit report.

- Indirect Impact: While the DEA itself does not impact your credit rating, the original unpaid debt may already have had an effect. Timely and regular deductions from earnings can prevent further impact on your credit score.

Interaction with Other Debt Solutions

Managing multiple debts can be challenging, especially when different types of debt recovery methods are in place.

- Attachment of Earnings Orders: A Direct Earnings Attachment is similar to an Attachment of Earnings Order but is administratively handled by the DWP instead of through the civil courts.

- Debt Consolidation: If you are struggling with multiple debts, a formal debt solution such as a debt consolidation plan might be a good option. Consolidating multiple repayment schedules into one can ease financial strain.

Common Scenarios in Direct Earnings Attachments

Direct Earnings Attachments can be complex, especially when it comes to irregular payments, bonuses, or other types of compensation payments. Here’s how DEAs apply in various scenarios.

Handling Bonuses

- Bonuses and Commission Payments: Any bonus or commission is considered part of your regular payments and, therefore, subject to Direct Earnings Attachment deductions. Employers must include these earnings when calculating the correct percentage rate for that pay period.

- Correct Percentage Rate: It is crucial for employers to apply the correct percentage deduction rate for bonuses to prevent incorrect deduction amounts.

Managing Holiday Pay Deductions

- Weeks Holiday Pay: If you take holiday leave and receive holiday pay, your Direct Earnings Attachment will apply to the amount paid during that period. Employers must treat holiday pay as part of your qualifying earnings when calculating deductions.

- Advance of Holiday Pay: If holiday pay is paid in advance, it must be deducted accordingly, and any incorrect deductions must be rectified by the employer.

Protected Earnings Limits

The protected earnings limit ensures that you still have enough income after deductions to afford basic living expenses.

- Minimum Earnings Requirement: If deductions push your income below the protected earnings limit, the Direct Earnings Attachment may be paused until your earnings are sufficient.

- Application for Hardship Exemption: If you are experiencing severe financial difficulty due to a Direct Earnings Attachment, you can apply to the DWP for a hardship exemption, which can reduce or halt deductions temporarily.

Consequences of Non-Compliance

There are consequences for both employers and employees if Direct Earnings Attachment regulations are not adhered to properly.

- Employer Penalties: Employers who fail to make the required deductions can be penalized by the DWP. This can include fines or legal action for failing to fulfill their legal responsibilities.

- Employee Consequences: Ignoring a Direct Earnings Attachment or failing to respond to debt notices may result in more severe enforcement actions, such as additional legal costs, attachment of earnings orders, or criminal offences in extreme cases.

How to Challenge a Direct Earnings Attachment

If you believe a Direct Earnings Attachment is incorrect or you face severe financial strain, it is possible to challenge the attachment.

- Application for Hardship Exemption: Contact the DWP or the relevant government department and explain your financial circumstances in writing. Be sure to provide supporting documentation to strengthen your claim.

- Incorrect Deductions: If the deduction percentage is incorrect, you should inform your employer immediately so they can coordinate with the DWP to rectify the error.

Resources for Further Information on Direct Earnings Attachments

For more guidance on Direct Earnings Attachments and how to manage them, there are several resources that can help:

- Department for Work and Pensions: The DWP website provides detailed information and guidelines on how Direct Earnings Attachments work and the rights of both employers and employees.

- Citizens Advice Bureau: They provide free, confidential advice and can help you understand your legal obligations and rights regarding Direct Earnings Attachments.

- National Debtline: This free debt advice service can assist with understanding Direct Earnings Attachments and developing a repayment schedule that works for you.

Conclusion

If you’re facing a Direct Earnings Attachment, don’t let it overwhelm you. Contact relevant authorities today to understand your options and take back control of your finances.

ALSO READ: What Happens If a Company Can’t Make Payroll

FAQs

No, employers have a legal obligation to comply with a Direct Earnings Attachment and make the necessary deductions from employee wages.

If your earnings change, your employer must adjust the deduction percentage rate to match your earnings for that period, ensuring compliance with the protected earnings limit.

Yes, you can contact the DWP to agree on a repayment plan before a Direct Earnings Attachment is issued. Setting up an acceptable repayment plan can prevent further action.

No, Direct Earnings Attachment deductions are made after statutory deductions, including pension contributions, student loan repayment, and National Insurance contributions.