Running a cleaning business comes with its own set of challenges, from managing multiple clients to keeping a close eye on your cash flow and business expenses. One crucial aspect of maintaining a successful operation is managing your finances efficiently. The right accounting software can save you time, reduce human error, and allow you to focus on what you do best: growing your cleaning business. This comprehensive guide will walk you through the best accounting software options for cleaning businesses, helping you identify the best fit for your unique needs.

The best accounting software for cleaning businesses not only makes bookkeeping simple but also helps you track payments, generate reports, and manage payroll, all in one place. With so many options available, choosing the right software can feel overwhelming. But don’t worry—by the end of this guide, you’ll have all the knowledge you need to make an informed decision.

Why Accounting Software Matters for Cleaning Businesses

Cleaning businesses, whether residential, commercial, or specialized, face several accounting challenges. The ability to track expenses, manage payroll, oversee employee expenses, and maintain accurate financial records is crucial for your cleaning business’s overall financial health.

Accounting software helps cleaning business owners streamline their business operations by automating manual processes. This not only saves time but also significantly reduces the risk of errors. Whether you run a small, move-out cleaning service or a large enterprise-level commercial cleaning business, accounting software can handle essential functions like invoicing, payment tracking, payroll management, and expense categorization—all while helping you comply with tax requirements.

For the cleaning industry, managing financial records in real-time allows you to make more informed decisions regarding your day-to-day operations, staffing, and future investments. A good accounting software solution will integrate seamlessly with your cleaning service management tools, reducing administrative tasks and allowing you to concentrate on growing your business.

Comparing Top Accounting Software for Cleaning Businesses

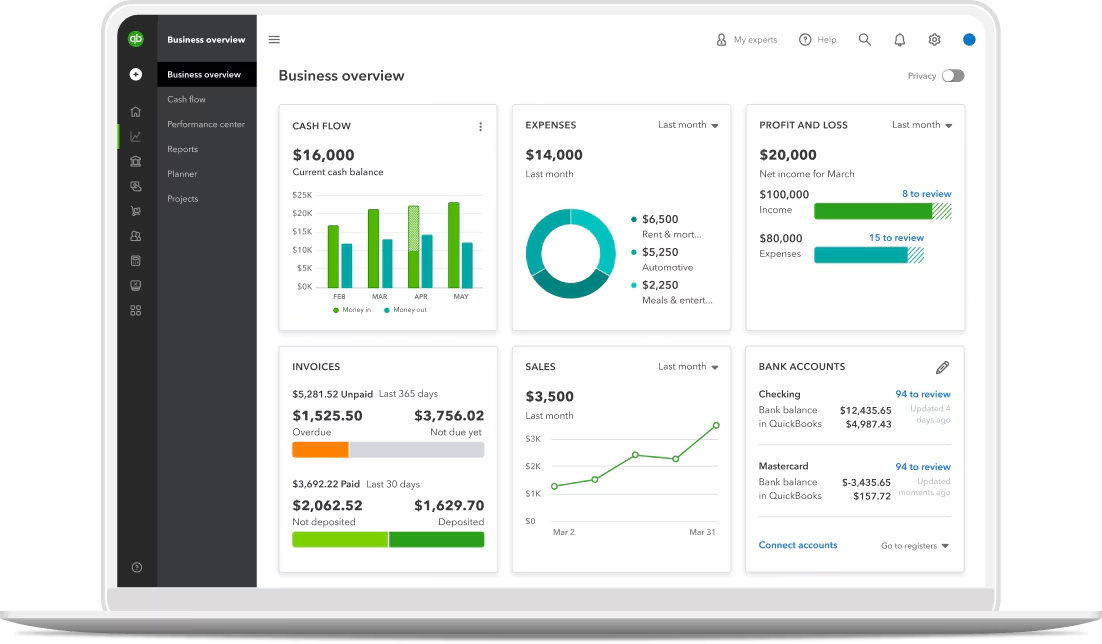

QuickBooks Online

QuickBooks Online has long been a leader in accounting software, known for its versatility, scalability, and user-friendly interface. It’s an excellent option for cleaning businesses, whether you’re managing a solo operation or overseeing a larger team.

QuickBooks provides you with the flexibility to manage your finances on the go, using either a desktop version or the highly efficient mobile app. It offers features like automatic invoice reminders, expense tracking, payroll management, and more. For cleaning businesses, the ability to track client payments, send invoices, and get paid faster is especially useful.

With QuickBooks Online, you can also customize your invoicing features to create a professional and branded experience for your clients. The software integrates well with other tools, allowing you to manage your cleaning appointments and scheduling while handling your finances seamlessly.

Key Features of QuickBooks Online

- User-Friendly Interface: Easy to learn and navigate, making it accessible for non-accountants and small business owners.

- Payroll and Tax Features: Calculate payroll for your cleaning staff, file taxes effortlessly, and track expenses and payments.

- Detailed Reporting: QuickBooks provides financial reports that offer a deeper understanding of your cleaning business’s financial health, such as profit and loss statements, cash flow reports, and detailed job cost analysis.

Challenges: The main downside is that QuickBooks may feel expensive, particularly if you’re just starting and have a limited budget. However, the value it brings to streamlining your financial operations and day-to-day tasks might outweigh the costs.

FreshBooks

FreshBooks is another excellent choice for cleaning businesses, particularly those that focus on customer relations and want easy, automated solutions for accounting processes.

FreshBooks puts emphasis on invoicing and time tracking, which makes it highly useful for cleaning services that bill by the hour. You can create personalized invoices that automatically add details for individual clients, ensuring accuracy and consistency. FreshBooks also allows you to automate late payment reminders, eliminating the hassle of manually following up on overdue payments.

FreshBooks’ simplicity is ideal if you’re not an accounting pro. You get comprehensive expense tracking, including categorization and receipt uploads. Their mobile application means you can work from anywhere—a crucial feature when you’re moving between job sites.

Key Features of FreshBooks

- Automation: From automated invoice reminders to recurring billing, FreshBooks significantly reduces your workload.

- Client Portal: FreshBooks offers a client portal, giving your clients an easy way to view invoices and make online payments.

- Flexible Payment Options: Accept payments via credit card, bank transfer, or other payment methods.

Challenges: For those with large teams, FreshBooks’ features might seem limited compared to more expansive software like QuickBooks or Xero. However, for smaller cleaning businesses, FreshBooks provides excellent functionality at a reasonable price.

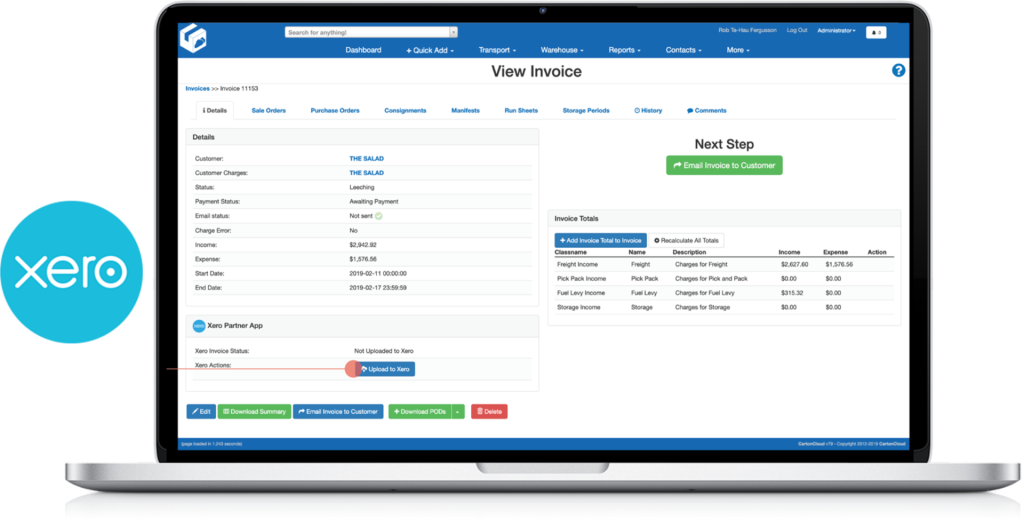

Xero

Xero is another top contender for the best accounting software for cleaning businesses. It’s particularly powerful for businesses needing robust automation capabilities, with excellent integrations and features that scale as you grow.

Xero helps you automate repetitive tasks, such as reconciling transactions or setting up recurring invoices, which saves you valuable time. Plus, with the ability to connect your bank accounts, you can get real-time views of your cash flow, making it easier to predict and plan your finances effectively.

Another standout feature of Xero is its ability to manage different currencies, which is helpful if your cleaning business has international clients or suppliers. Xero also provides project management tools, making it easier to assign cleaning jobs, set timelines, and track progress—key aspects for both residential and commercial cleaning companies.

Key Features of Xero

- Scalable: Suitable for growing businesses, with multiple features that can support more complex financial needs.

- Detailed Financial Reporting: Access to an extensive range of financial statements and reports to keep track of your profitability.

- Integration: Xero integrates seamlessly with hundreds of other apps, including cleaning service software and booking tools, making it an all-in-one tool for managing both field service operations and financial processes.

Challenges: Xero is not as beginner-friendly as other software options. There may be a learning curve, particularly for those unfamiliar with accounting. However, Xero offers tutorials and a strong customer support network to help you get started.

Leveraging Automation for Cleaning Businesses

Automation is key to running an efficient cleaning business. By using accounting software that offers automated features, you can save time and reduce errors. Features such as recurring invoices, automated payment reminders, and bank transaction reconciliation can make your life much easier.

For example, setting up recurring invoices for regular clients ensures timely billing without manual intervention. Automated payment reminders can help minimize overdue payments without the awkwardness of chasing clients. Automation isn’t just a convenience—it’s a necessity for busy business owners who need to optimize their time.

Using software like QuickBooks or FreshBooks, you can take advantage of automation to keep everything from invoicing to expense tracking running smoothly. With fewer admin tasks on your plate, you can devote more time and attention to growing your cleaning business.

Cloud-Based Solutions

When you’re constantly moving between client locations, it’s essential that your accounting software is cloud-based. Cloud-based solutions give you the flexibility to work from anywhere, on any device. Whether you’re in the office, on-site at a client’s property, or on a break, having all your financial data in one place ensures you never lose track.

QuickBooks, Xero, and FreshBooks all provide excellent cloud-based solutions that you can access from anywhere. Additionally, cloud-based software allows you to collaborate with accountants or bookkeepers, enabling seamless communication without the need for physical documents.

Cloud-based software also offers the advantage of real-time reporting, so your data is always up-to-date. This feature is crucial for cleaning businesses where decisions need to be made quickly. It also helps you keep on top of your finances by giving you visibility into your cash flow and financial status at any given time.

Specialized Accounting Software for Cleaning Businesses

If you’re looking for something even more tailored, there are specialized accounting software options designed specifically for cleaning businesses. These programs often come with extra features like job scheduling, client communication, and team management—all integrated with accounting tools.

Examples of Specialized Software

- Service Autopilot: Service Autopilot offers both operational and accounting tools, allowing you to schedule jobs, dispatch teams, and manage your finances all from one place. It’s particularly helpful for businesses managing multiple cleaners and clients.

- Jobber: Jobber combines job management and accounting, offering a cohesive solution for cleaning businesses. Its accounting features may not be as robust as standalone programs like QuickBooks, but it provides a good balance between managing client schedules and financial records.

These specialized software solutions give you a more industry-specific set of tools, but it’s important to weigh the trade-offs. While they offer operational advantages, they may lack the comprehensive financial management features available in broader accounting software like QuickBooks.

Managing Cash Flow in a Cleaning Business

Cash flow is the lifeblood of any business, and cleaning businesses are no exception. You need accounting software that can help you keep track of incoming payments, monitor overdue invoices, and get a clear view of where your money is going.

QuickBooks and Xero offer powerful cash flow tools that allow you to connect your bank accounts, monitor your accounts payable and receivable, and provide financial projections. By analyzing cash flow regularly, you can make informed decisions—such as investing in new equipment or expanding your cleaning team—without jeopardizing your financial stability.

Tips to Improve Cash Flow

- Use automated reminders for overdue invoices to reduce late payments.

- Offer multiple payment options to clients for convenience, which can speed up payments.

- Generate cash flow forecasts using built-in tools to anticipate potential challenges.

These practices will help you avoid common cash flow pitfalls, such as not having enough cash to cover operational costs during slower seasons.

Tax Compliance for Cleaning Businesses

Keeping track of tax deadlines and compliance can be daunting. Using accounting software that simplifies tax compliance can make all the difference. QuickBooks, Xero, and FreshBooks provide easy categorization for expenses, so you’re ready when tax season arrives.

QuickBooks allows you to calculate and file sales tax with ease, reducing errors and ensuring you’re compliant with your local regulations. FreshBooks provides a simple way to track tax-deductible expenses, ensuring you never miss any deductions that could save your cleaning business money.

Tax compliance isn’t just about paying your taxes—it’s about making sure you have everything organized throughout the year, minimizing your stress come tax time.

Payroll Management for Cleaning Teams

If you’re managing a team of cleaners, payroll becomes an essential part of your business operations. Accounting software like QuickBooks and Xero can handle payroll seamlessly, helping you pay your employees on time and keep track of payroll taxes and deductions.

With QuickBooks, you can set up direct deposits, automate payroll tax calculations, and generate payroll reports. Xero also offers payroll features that integrate with your financial data, giving you a holistic view of your employee expenses.

Using software that integrates payroll with your accounting system reduces errors and ensures you’re always compliant with employment laws. This is especially important as your cleaning business grows and you bring on more team members.

Customer Management and Tracking

Understanding your clients and their needs can give you an edge over your competition. Using accounting software that integrates with customer management systems allows you to keep all your client information in one place.

FreshBooks offers a simple client management system where you can track client history, including billing and payments. Xero also integrates with popular CRM tools to give you a more in-depth understanding of client interactions, allowing you to provide excellent customer service.

Customer tracking goes beyond accounting—it’s about building long-term relationships and ensuring you’re meeting your clients’ expectations. By keeping detailed notes and tracking client preferences, you can offer a more personalized experience that leads to repeat business and positive referrals.

Integrating with Other Tools

The best accounting software for cleaning businesses should integrate with other tools you’re using, such as scheduling, CRM, or project management software. Integration helps to centralize your data, minimizing manual data entry and reducing errors.

For example, QuickBooks integrates with popular booking software, making it easy to track income from your cleaning jobs. Xero’s open API means it integrates seamlessly with hundreds of other platforms, including payroll, CRM, and payment gateways.

These integrations are essential for service companies that need all their tools to work together efficiently. With the right integrations, you can automate tedious tasks and have a complete picture of your business, from field service operations to finances.

Conclusion

Choosing the best accounting software for a cleaning business is a critical step in managing your finances effectively and growing your business. QuickBooks Online, FreshBooks, and Xero are all strong contenders, each offering unique features to suit different needs. Whether you’re a small business just starting out or you’re managing a larger cleaning team, the right software can help you automate tasks, manage cash flow, and ensure tax compliance.

In addition to general accounting software, you might also consider specialized solutions that provide more industry-specific features like scheduling and client management. Ultimately, the key is to find a tool that fits seamlessly into your workflow, offering both accounting functionality and operational support.

Remember, accounting software should simplify your life, not complicate it. Take advantage of free trials to explore your options, consider the features that are most important for your business, and choose the software that best fits your needs.

ALSO READ: What Happens If a Company Can’t Make Payroll

FAQs

Xero is one of the most affordable options for small cleaning businesses, with pricing starting at $13 per month. FreshBooks is another budget-friendly choice, starting at $15 per month, depending on the features you need.

Not necessarily. While specialized software offers tools like scheduling and client management, general accounting software like QuickBooks, FreshBooks, and Xero can provide the accounting features you need, often with more comprehensive financial management tools.

Yes, most accounting software, including QuickBooks and Xero, integrates with popular scheduling tools. This allows you to track income, manage client appointments, and ensure all your data is connected in one place.

Many accounting software options include payroll management, but it may come at an additional cost. QuickBooks and Xero, for example, both offer payroll features that integrate with your financial data.