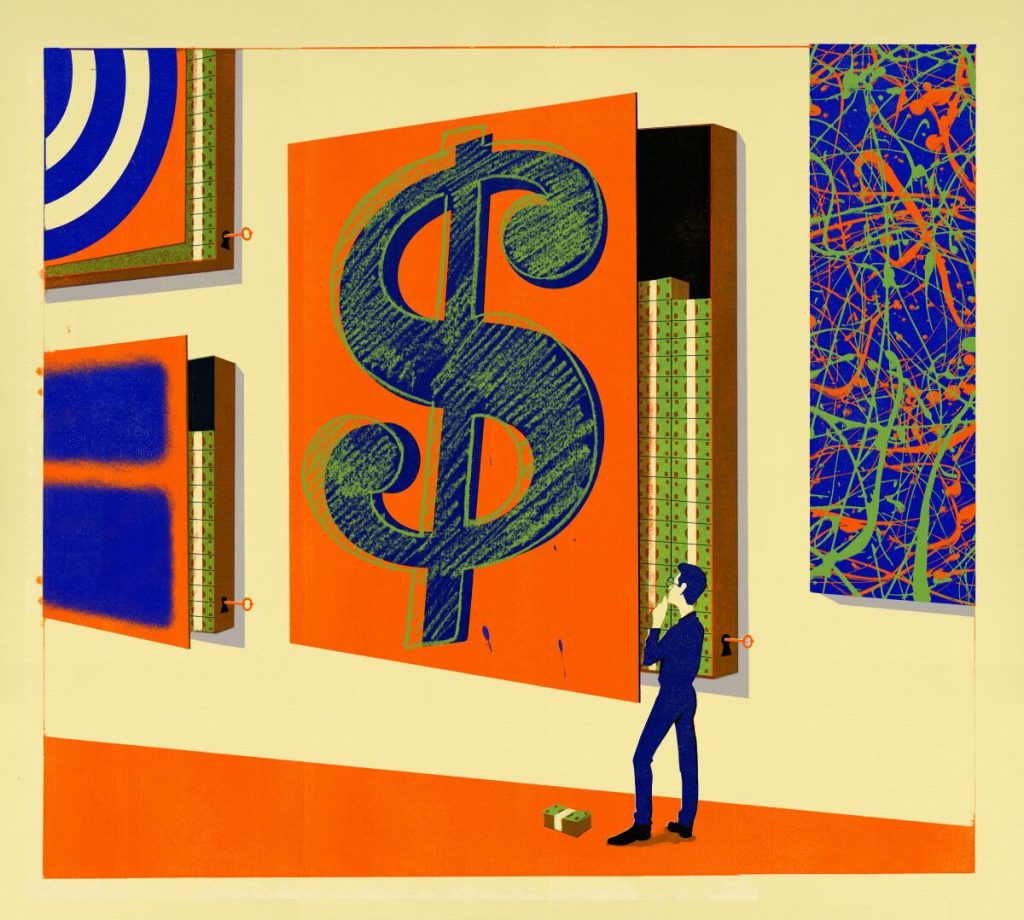

Art has long been regarded as a creative expression, but in the world of finance, it holds a different kind of value. The intersection between art and finance has created a dynamic market where art is used not only as a cultural asset but also as an investment tool. Understanding what kind of art is used in finance and how it functions as a financial asset is critical for both retail investors and institutional investors looking for diversification in their investment portfolios.

In recent years, art investments have gained popularity among the ultra-wealthy and institutional investors, offering a unique avenue for alternative investments. From paintings to sculptures, and even digital art, various forms of art serve as collateral for loans, are held in art investment funds, or even contribute to the art finance market. This article will explore the different forms of art used in finance, how they are valued, and how they can be leveraged in various investment strategies.

The Intersection of Art and Finance

Art as an investment asset has gained traction in the financial world. Historically, art was considered more of a decorative or cultural asset, but today, it plays a significant role in financial markets. Art finance refers to the services and products related to the management, buying, selling, and lending of art assets. The art market has expanded, attracting both art collectors and financial companies, such as private banks and specialist lenders, who understand the growing role of art as an alternative asset.

This intersection between art and finance has given rise to art-backed loans, art investment funds, and art-secured loans. For retail investors and ultra-wealthy collectors, these financial products can serve as a means to leverage art assets to achieve specific financial goals or objectives.

Importance of Artist Reputation

When it comes to what kind of art is used in finance, the reputation of the artist plays a crucial role. Well-established artists with a proven track record are typically more attractive to investors because their works tend to appreciate in value over time. Artists like Damien Hirst, whose works are frequently sold in high-profile auctions, are prime examples of artists whose reputation has helped increase the value of their artworks.

In contrast, emerging artists may present higher risks, but they also offer potential for significant returns if their works gain in recognition and value. Art investors often look for trends in the art market and data-driven market commentary to predict the potential of works from emerging artists.

Established vs. Emerging Artists

The art market divides artists into two main categories: established and emerging. Established artists, with a history of successful sales and a strong reputation, are more predictable and often fetch higher prices at auctions. These artists include figures like Picasso, Andy Warhol, and more contemporary names like Jeff Koons and Banksy. For investors, their work is seen as a stable financial asset, offering lower risk but potentially lower returns compared to emerging artists.

Emerging artists, on the other hand, represent a higher degree of risk but also offer the possibility of higher returns as their work gains recognition and their reputation grows. For art collectors, this can be an exciting opportunity to invest early in an artist’s career. Investors in art-focused financial products, such as art investment funds, might consider a mixture of established and emerging artists to balance the risks and rewards within their investment portfolios.

Provenance and Its Role in Valuation

Provenance, or the history of ownership, plays a significant role in determining the value of an artwork in the financial market. The origin of a piece, its previous owners, and its sale history provide a transparent record that influences both buyers and investors in making informed decisions. For example, if a painting was previously owned by a prominent art collector or appeared in high-profile auctions, its provenance will likely increase its value.

For financial companies, particularly those in the art lending market or art investment funds, provenance helps reduce the risk of purchasing or lending against a counterfeit piece. Buyers and lenders can be more confident in their investments when they know the authenticity and historical significance of the artwork.

Types of Art as Collateral

Art can be used as collateral in a variety of financial transactions, such as loans or as part of an art-backed investment strategy. The types of art that are commonly used as collateral in financial products include traditional art forms like paintings and sculptures, as well as emerging categories such as photography and digital art.

Traditional Art Forms

Traditional art forms, including paintings, sculptures, and other decorative arts, have historically been the most commonly used in art finance. These forms of art have established markets, making them easier to evaluate and offer as collateral for loans. For example, a painting by a renowned artist like Pablo Picasso can serve as collateral for a loan, with the artwork’s value being determined by auction prices and market demand.

Emerging Art Categories

In recent years, emerging art categories such as photography and digital artwork have become more prominent in the financial market. These art forms are seen as viable investments, particularly as more collectors and investors see potential in new mediums. Digital art, including blockchain-based artworks (NFTs), has especially attracted attention for its ability to offer a new kind of financial product.

Categories of Art Investments

There are various categories of art investments, each offering unique opportunities and risks for investors.

Paintings

Paintings are the most traditional and widely recognized form of art in the financial world. Famous works of art by well-known artists like Van Gogh, Monet, or Warhol often fetch millions at auctions, making them an attractive asset class for wealthy investors. Paintings are considered relatively stable investments, with a strong market history.

Sculptures

Sculptures, while often more expensive due to their size and complexity, also hold significant value in the art market. Sculptors like Henry Moore or modern artists like Jeff Koons have seen their works sold for record-breaking amounts, and sculptures often serve as collateral for art-secured loans in the art finance sector.

Photography

Photography has become an increasingly important category within the art market. In particular, contemporary photography by renowned artists can provide investors with alternative asset classes that diversify their portfolios. The value of photographs can also be affected by factors like print runs, authenticity, and artist reputation.

Decorative Arts

Decorative arts, including furniture, ceramics, and textiles, are also a growing category in the art market. These types of art are often used in alternative asset classes for investors who are looking to diversify their portfolios beyond traditional investment products.

Market Trends Influencing Art Valuations

The valuation of art assets is influenced by a variety of market conditions and trends. Economic cycles, demand for specific artists, and overall market conditions all play a role in determining the value of an artwork.

Economic Conditions and Their Impact

Economic conditions can have a significant impact on the art market. During periods of economic growth, demand for art may rise as investors seek to diversify their portfolios with alternative assets. Conversely, during economic downturns, the art market may experience slower sales, affecting both the value of art and the overall art lending market.

Popularity of Different Art Forms

The popularity of different art forms can also drive valuations. Contemporary artists, particularly those whose works are considered groundbreaking or trendsetting, tend to see higher demand and, as a result, higher valuations.

Risks Associated with Art Financing

While art financing offers unique opportunities, it also comes with its own set of risks. The art market is known for its volatility, and the value of art can fluctuate greatly depending on a variety of factors.

Market Volatility

One of the primary risks in art financing is market volatility. The value of art can change rapidly based on factors like economic conditions, artist reputation, and trends in the broader art market. For investors, this means the potential for significant financial losses if the market turns downward.

Authentication Challenges

The art market is also faced with the challenge of authentication. Counterfeit or misattributed artworks can be a risk for both lenders and investors. Having a reliable provenance and working with trusted specialists helps mitigate this risk.

Leveraging Art in Financial Strategies

Art can be leveraged as part of a broader financial strategy. Whether used as collateral for loans, as part of an alternative investment portion in a portfolio, or through art investment funds, art can offer diversification and potential financial growth.

Art as an Investment Asset

Art can function as both a long-term asset and a liquid financial product, depending on the investor’s strategy. Through art-backed loans or participation in art investment funds, investors can gain exposure to the art market without needing to own physical artworks.

Art Loans and Their Mechanisms

Art loans, such as art-secured loans or non-recourse loans, allow collectors and investors to use their art assets as collateral for borrowing. These loans are typically offered by specialist lenders, private banks, and financial companies that understand the unique nature of art as collateral.

Conclusion

Art has evolved from being merely a cultural asset to a key component in modern financial strategies. The intersection of art and finance has created new opportunities for investors, whether retail investors, institutional investors, or the ultra-wealthy. By understanding the various forms of art used in finance, such as paintings, sculptures, and digital art, and exploring art-backed loans and art investment funds, investors can leverage art to meet their financial goals and objectives. However, it is essential to be mindful of the risks, such as market volatility and authentication challenges, when incorporating art into an investment portfolio.

ALSO READ: What Must an Entrepreneur Assume When Starting a Business

FAQs

Art finance involves financial products and services that use art as a collateral or investment asset. It includes art-secured loans, art investment funds, and other financial services aimed at helping individuals and institutions leverage their art assets for financial growth.

Art used in finance includes paintings, sculptures, photography, and digital art, all of which can be utilized as collateral in art loans, included in art investment funds, or held as part of a diversified investment strategy.

Art can serve as collateral for loans in the form of art-secured loans or non-recourse loans. The value of the art is assessed, and the loan is granted based on the appraised value of the artwork.

Yes, like any investment, art investments carry risk. Market volatility, changes in demand for specific artists, and authentication challenges can impact the value of art assets, making it essential for investors to conduct thorough research and seek professional investment advice.

Yes, retail investors can participate in art investments through platforms offering art investment funds or art-backed loans. These options allow smaller investors to gain exposure to the art market without the need for purchasing physical artwork directly.